With the latest update to the PBJ Policy Manual, CMS makes very clear its rules on removing meal breaks from Payroll-Based Journal reports.

Take note: ALWAYS remove 30 minutes for lunch in your PBJ reports. Even when your staff works through lunch, those 30 minutes CANNOT be reported.

CMS explicitly details the PBJ meal break policy

With confusion and inconsistent reporting by facilities, CMS updated its PBJ Policy Manual with detailed guidance on applying Meal Breaks.

Technically this isn’t a change in policy, but a clarification likely driven by findings in PBJ audits. Many facilities were getting “caught” over-reporting staffing hours due to not adequately deducting meal breaks for all employees (regardless of pay type).

The policy manual now has a subsection entitled “Meal Break Policy” (pages 2-4 and 2-5) that states:

Meal times, paid or unpaid, shall not be reported for all staff (exempt, nonexempt, and contract). Facilities must deduct the time allotted for meals from each employee’s daily hours. For each full shift that staff (exempt, non-exempt, or contract) are paid to work, a 30 minute meal break must be deducted from their shift (whether or not the employee actually takes a meal break). For example:

For staff with unpaid meal-times, who work:

- Shifts of 8 hours and are paid to work 7.5 hours (with a 30 minute unpaid meal-break), then 7.5 hours shall be reported.

- Shifts of 8.5 hours and are paid to work 8 hours (with a 30 minute unpaid meal-break), then 8 hours shall be reported.

- Shifts of 12 hours and are paid to work 11.5 hours (with a 30 minute unpaid meal-break), then 11.5 hours shall be reported.

- Shifts of 16 hours (two 8-hour shifts) and are paid to work 15 hours (with two 30 minute unpaid meal-breaks), then 15 hours shall be reported.

- Shifts of 17 hours (two 8.5-hour shifts) and are paid to work 16 hours (with two 30 minute unpaid meal-breaks), then 16 hours shall be reported.

For staff with paid meal-times, who work:

- Shifts of 8 hours and are paid to work 8 hours (including a 30 minute paid meal-break), then 7.5 hours shall be reported.

- Shifts of 8.5 hours and are paid to work 8.5 hours (including a 30 minute paid meal-break), then 8 hours shall be reported.

- Shifts of 12 hours and are paid to work 12 hours (including a 30 minute paid meal-break), then 11.5 hours shall be reported.

- Shifts of 16 hours (two 8-hour shifts) and are paid to work 16 hours (including two 30 minute paid meal- breaks), then 15 hours shall be reported.

- Shifts of 17 hours (two 8.5-hour shifts) and are paid to work 17 hours (including two 30 minute paid meal-breaks), then 16 hours shall be reported.

The above examples are the minimum requirements for deducting hours for meal breaks. If staff take a meal break that is longer than 30 minutes during a shift, the actual time of the meal break should be removed and only hours actually providing services should be reported. For example, if an employee works a shift of 8 hours and takes a 45 minute meal break, then 7.25 hours (7 hours and 15 minutes) shall be reported. Similarly, we expect facilities to deduct time for meal breaks for staff that work less than an 8 hour shift, and only report the hours that staff are paid to deliver services to residents.

Why standardize breaks?

We view this updated policy guidance is another effort to level the PBJ playing field. With a wide range of policies on working through lunch at facilities across the country, the total hours reported were not consistent and potentially could skew a facility’s Five-Star rating.

CMS said as much when they updated their PBJ Policy FAQ document to better explain its rationale:

Question 2: I have staff that sometimes work through their lunch break, or a portion of it. Why must I deduct 30 minutes for a meal break, regardless of whether or not the employee actually ate?

Answer: First, for staff that work through lunch (paid or unpaid), there is no way to verify (e.g., from payroll) the portion of their meal break that was spent working vs. eating. Also, some facilities pay for meal breaks, and some do not. Allowing some facilities to report hours for paid meal breaks would result in reporting higher or lower levels of staffing based on whether or not a facility pays for meal breaks, instead of actual differences in the amount of direct resident care their staff provide. Therefore, in order to measure all facilities equally, we require all facilities to deduct 30 minutes per shift (see PBJ Policy Manual section 2.2.c).

Using ezPBJ to deduct meal breaks

There are many ways to stay compliant with the PBJ meal break rules:

- Establish standard punching policies requiring staff to punch in and out for a 30 minute lunch. If someone works through lunch, add it back but track that time separately to keep it out of PBJ

- Use ezPBJ to automatically deduct meal breaks from your clock or payroll files

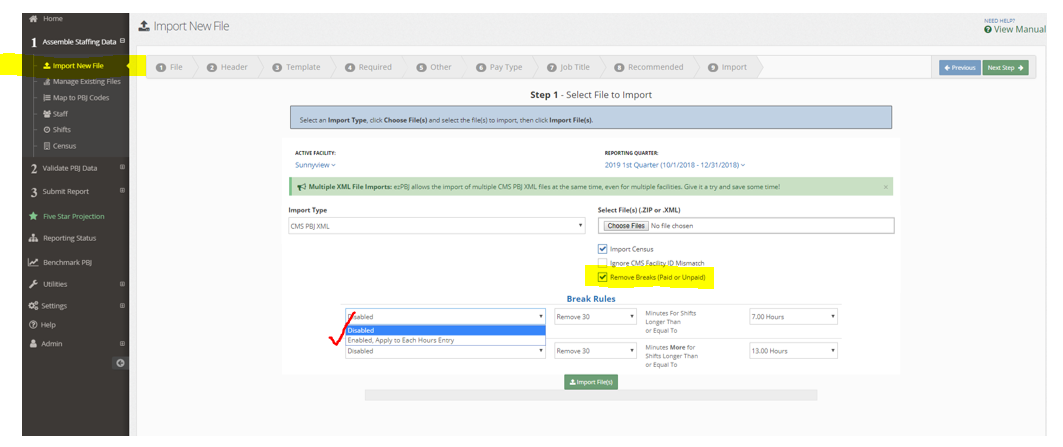

It’s simple in ezPBJ to deduct meal breaks from a CMS PBJ XML file:

- From the left menu options, select 1 Assemble Staffing Data > Import New File

- Tick the third checkbox under Select File(s) – Remove Breaks (Paid or Unpaid)

- Click the first dropdown box to change the “Disabled” break rule to “Enabled, Apply to Each Hours Entry”

- If you wish to remove more than the default 30 minutes, click the second dropdown to change “Remove 30” to the minutes desired

- If you wish to change the rule from applying to shifts longer than or equal to 7 hours, click the third dropdown to change “7.00 Hours” to the number of hours desired

- You can now select the corresponding XML file(s) and click the green Import File(s) button

You can also deduct meal breaks from XLS and CSV reports of punches or total times from almost any source system. Even better, ezPBJ saves the Meal Break rule into a Template and applies it to all future PBJ reports, so you will stay in compliance.

Contact us to see how we can help you get Meal Breaks removed from your PBJ reports.